on a successful Forex trading journey requires meticulous planning and strategic execution. The Currency Chronicles unfolds the top 10 Forex trading plans that can guide both novice and seasoned traders towards financial success.

Table of Contents

1. The Trend-Following Strategy

Embrace the trend-following approach by identifying and riding market trends. This plan involves analyzing price charts and using indicators to capture the momentum, allowing traders to capitalize on sustained price movements.

2. Swing Trading Mastery

Master the art of swing trading, a strategy that seeks to capture “swings” or short to medium-term price movements. Traders employing this plan typically hold positions for a few days to weeks, taking advantage of market fluctuations.

3. Breakout Breakthrough

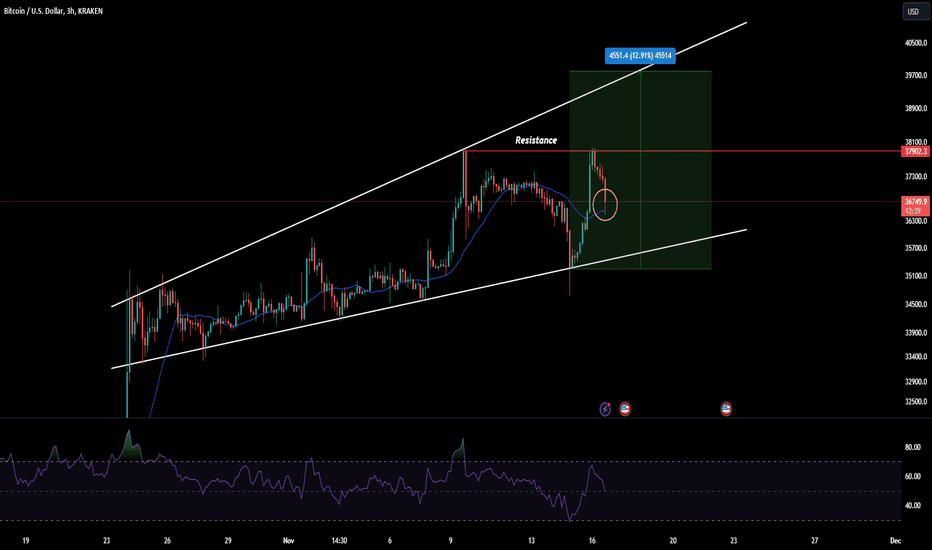

The breakout strategy involves identifying key support and resistance levels. Traders enter positions when the price breaks through these levels, anticipating a significant price movement. This plan is effective during periods of market volatility.

4. Scalping for Quick Wins

For those seeking rapid, small profits, scalping is the plan of choice. Traders executing this strategy make numerous trades in a day, profiting from small price movements. Precision and quick decision-making are crucial for success.

5. Carry Trade Wisdom

The carry trade plan involves capitalizing on interest rate differentials between currencies. Traders go long on a currency with a higher interest rate and short on a currency with a lower interest rate, profiting from the interest rate spread.

6. Fibonacci Retracement Strategy

Utilize the Fibonacci retracement levels to identify potential reversal points in the market. This plan involves drawing Fibonacci lines on price charts, helping traders identify key support and resistance levels.

7. Risk Reversal Tactics

Prioritize risk management with the risk reversal strategy. This plan involves using options to hedge against potential losses, providing a safety net for traders in volatile market conditions.

8. Algorithmic Advantage

Embrace algorithmic Forex Trading Plans that leverage computer algorithms to execute trades automatically. Algorithmic trading removes emotional bias and ensures rapid execution based on predefined criteria.

9. News Forex Trading Plans Proficiency

Stay informed about economic events and news releases with the news trading plan. Traders using this strategy capitalize on market volatility triggered by major economic announcements.

10. Diversification for Stability

Diversify your trading portfolio to mitigate risks. This plan involves spreading investments across different currency pairs and other financial instruments, ensuring that a single unfavorable movement doesn’t significantly impact overall performance.

In conclusion, the Currency Chronicles unveils these ten powerful Forex Trading Plans plans, each offering a unique approach to the dynamic world of currency trading. Traders can leverage these strategies based on their risk tolerance, preferences, and market conditions, paving the way for a successful Forex trading journey.

FAQs: Forex Trading Plans Strategies

Q1: What is the best trading plan for beginners? A1: For beginners, starting with a trend-following strategy is recommended. It provides a straightforward approach to understanding market dynamics.

Q2: How do I manage risk when scalping? A2: Scalping requires strict risk management. Set predefined stop-loss levels and adhere to them consistently to protect your capital.

Q3: Is algorithmic trading suitable for everyone? A3: While algorithmic trading offers efficiency, it’s best suited for those with a solid understanding of programming and market dynamics.

Q4: Can I use multiple trading plans simultaneously? A4: Yes, diversifying your approach by combining strategies is a common practice. However, ensure each plan aligns with your risk tolerance and overall trading goals.

Q5: How often should I review and adjust my trading plan? A5: Regularly review your plan, especially if market conditions change. Adjustments may be needed to stay aligned with evolving trends.

Q6: What’s the role of news trading in a portfolio? A6: News trading adds volatility to a portfolio. Include it strategically but be cautious, as sudden market movements can carry risks.

Q7: Can swing trading be automated? A7: While swing trading can be semi-automated, the human element is crucial for identifying nuanced market trends that algorithms may miss.

Q8: How can I stay updated on economic events for news trading? A8: Use economic calendars and news platforms to stay informed about scheduled economic releases and events that may impact the market.

Q9: What’s the key to successful carry trading? A9: Successful carry trading requires thorough research on interest rate differentials and a disciplined approach to managing positions.

Q10: Is diversification essential for Forex Trading Plans? A10: Yes, diversification is a key risk management strategy. Spreading investments across various assets helps minimize the impact of adverse market movements.

Looking for News: News

Looking for Latest Trends: Finance